PayTax.NZ Fixed Asset Management and IR3B Tax Filing Guide

Updated At : Mon, Nov 10, 2025

This document is a knowledge base article for PayTax.NZ, introducing two core features:

- Fixed Asset Management and Depreciation Calculation - Asset Module

- IR3B Simplified Tax Return - IR3B Auto-Download Feature

Part One: Fixed Asset Management and Depreciation Calculation

What are Fixed Assets?

Fixed assets are tangible assets that are owned by a business or self-employed individual, used in business operations, and have a useful life of more than one year. In New Zealand, these assets can be depreciated according to regulations set by the Inland Revenue Department (IRD), which reduces taxable income.

Common types of fixed assets include:

- Computer Equipment (Computers, Laptops, Servers)

- Vehicles (Cars, Trucks, Vans)

- Office Equipment (Printers, Desks, Chairs)

- Plant & Machinery (Production equipment, tools)

- Furniture & Fixtures (Office furniture, shelving)

Asset Management Features in PayTax.NZ

PayTax.NZ provides a comprehensive fixed asset management system that allows you to:

1. Create and Manage Assets

- Record basic asset information: name, code, type, and description

- Enter purchase date and purchase price

- Set residual value (expected value at end of asset life)

- Define useful life in years

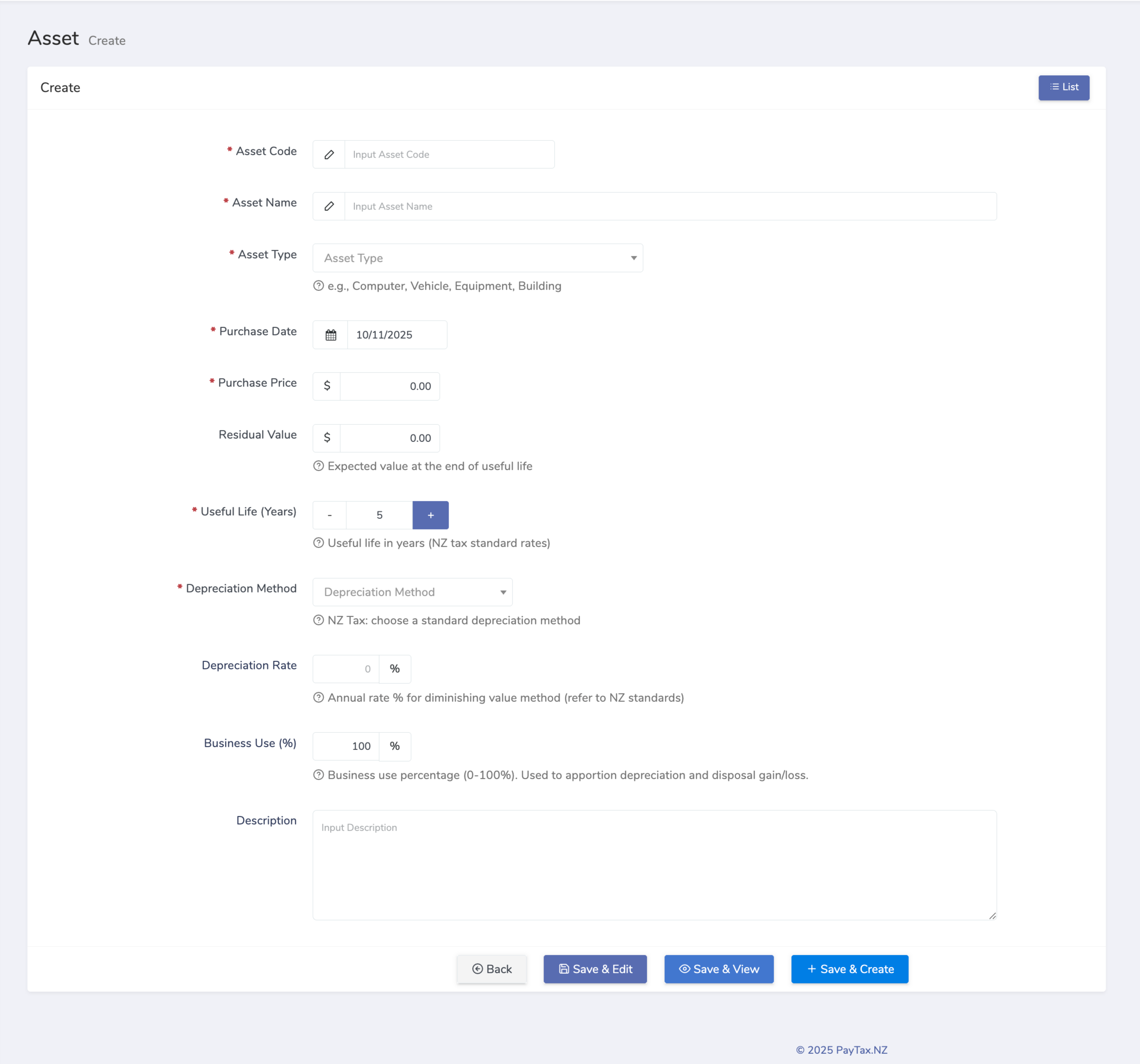

Steps to Enter Asset Information:

- Log in to the PayTax.NZ admin dashboard

- Navigate to "Assets" module

- Click "Add New Asset" button

- Fill in the required information:

- Asset Code: Unique identifier for the asset (e.g., COMP-001, VEH-2024-01)

- Asset Name: Descriptive name (e.g., Dell Laptop, Toyota Camry)

- Asset Type: Select from predefined categories (Computer, Vehicle, Equipment, etc.)

- Purchase Date: The date the asset was purchased

- Purchase Price: Original cost of the asset (including shipping, installation, etc.)

- Residual Value: Expected value at end of useful life

- Useful Life (Years): Based on New Zealand IRD guidelines

- Depreciation Method: Choose between straight-line or diminishing value (see details below)

- Save the asset record

2. Choose a Depreciation Method

PayTax.NZ supports two depreciation methods approved by the New Zealand IRD:

Straight-Line Depreciation

- Characteristics: Equal depreciation amount each year

- Formula: Annual Depreciation = (Purchase Price - Residual Value) ÷ Useful Life Years

- Best For: Most assets, simplified financial reporting

- Example: Asset cost 1,500, residual value $200, useful life 3 years

- Annual Depreciation = (1,500−200) ÷ 3 = $433.33

- Year 1: $433.33

- Year 2: $433.33

- Year 3: $433.33

Diminishing Value Method (Reducing Balance)

- Characteristics: Depreciation decreases each year; higher depreciation in early years

- Formula: Annual Depreciation = Book Value × Depreciation Rate

- Best For: Technology, equipment that depreciates quickly

- Example: 20% depreciation rate

- Purchase Price: $1,500

- Year 1: 1,500×20300 (Book Value: $1,200)

- Year 2: 1,200×20240 (Book Value: $960)

- Year 3: 960×20192 (Book Value: $768)

New Zealand IRD Recommended Asset Lives

The New Zealand IRD provides guidelines for useful life and depreciation rates:

| Asset Type | Recommended Life | Suggested Rate (Diminishing Value) |

|---|---|---|

| Buildings | 40 years | 2.5% |

| Vehicles | 3-5 years | 15-20% |

| Computer Equipment | 3-5 years | 15-20% |

| Office Equipment | 3-5 years | 12-15% |

| Plant & Machinery | Varies | 6-20% |

Asset Status Tracking

PayTax.NZ automatically tracks your asset status:

-

In Use

- Asset is actively depreciating

- System continues to calculate depreciation each period

-

Fully Depreciated

- Accumulated depreciation = (Purchase Price - Residual Value)

- Asset no longer generates depreciation

- May still be in use but cannot be claimed as further deduction

-

Disposed

- Asset has been sold or scrapped

- Disposal date and price recorded

- System calculates gain or loss on disposal

Asset Depreciation Calculation Example

Scenario: You purchase a Dell laptop computer on January 15, 2024 for business use.

Details:

- Purchase Price: $1,500.00

- Residual Value: $200.00

- Useful Life: 3 years

- Depreciation Method: Straight-Line

- Purchase Date: January 15, 2024

Calculation Result:

- Annual Depreciation: (1,500−200) ÷ 3 = $433.33

- Accumulated Depreciation (End of 2024): $433.33

- Book Value (End of 2024): 1,500−433.33 = $1,066.67

- Tax Deduction (2024/2025 FY): $433.33

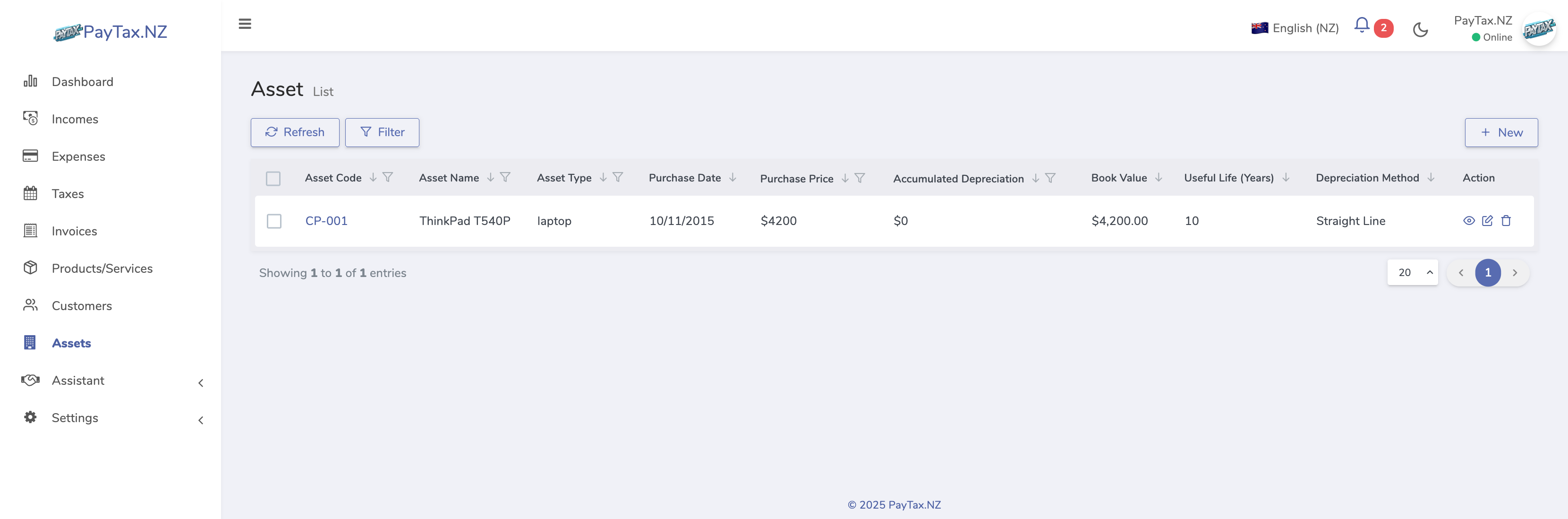

Viewing Asset Information and Depreciation Reports

In PayTax.NZ, you can view:

- Asset List

- Overview of all assets

- Quick status view

- Search by type or name

-

Asset Detail Page

- Complete asset information

- Current book value

- Annual depreciation schedule

-

Depreciation Report

- Annual depreciation details

- Period-based statistics

- Data for tax filing purposes

Disposing of Fixed Assets

When you sell or scrap an asset:

- Go to the asset detail page

- Set the "Disposal Date"

- Enter "Disposal Price" (sale price or zero for scrapping)

- System automatically calculates:

- Depreciation up to disposal date

- Gain/Loss on Disposal = Disposal Price - Book Value

- Disposal gain/loss appears in your tax return

Example:

- Asset Book Value: $800

- Sale Price: $900

- Disposal Gain: 900−800 = $100

This gain must be included in your tax filing.

Best Practices

-

Record Purchase Information Accurately

- Ensure purchase dates are correct

- Include all costs (transport, installation, etc.)

-

Select Appropriate Useful Life

- Follow New Zealand IRD guidelines

- Consider actual expected use period

-

Keep Records Updated

- Record asset disposals promptly

- Verify depreciation calculations regularly

-

Maintain Supporting Documentation

- Keep purchase invoices

- Retain disposal documentation

- Have records ready for audit

Part Two: IR3B Simplified Tax Return

What is IR3B?

IR3B is a simplified tax return form for sole traders and self-employed individuals provided by the New Zealand Inland Revenue Department (IRD).

IR3B vs IR10 Comparison:

| Feature | IR3B | IR10 |

|---|---|---|

| Suitable For | Sole traders, self-employed | Complex business structures |

| Balance Sheet Required | No | Yes |

| Audit Required | Usually no | Usually yes |

| Filing Complexity | Simple | Complex |

| Expense Categories | Standard | Detailed |

When to Use IR3B:

- You are a sole trader or self-employed

- Your business is relatively straightforward

- You don't need to file detailed balance sheets

PayTax.NZ IR3B Auto-Download Feature

PayTax.NZ provides a powerful IR3B auto-generation and download feature that simplifies your tax filing process.

Feature Highlights

-

Automatic Data Extraction

- System automatically extracts required data from your records

- No manual calculation needed

-

Intelligent Expense Categorization

- System automatically categorizes expenses per IRD standards

- Supports 19 standard IRD expense categories

-

Real-Time PDF Generation

- Fresh data on every download

- Professional PDF format

-

Multi-Language Support

- English, Simplified Chinese, Traditional Chinese

- Automatically generated based on your preference

-

Security & Privacy

- Download only your own company's reports

- Multi-tenancy isolation ensures data security

IR3B Expense Categories

PayTax.NZ supports the following standard IRD expense categories:

| Category | Description | Examples |

|---|---|---|

| Sales | Income from sales | Product sales, service revenue |

| Purchases / Cost of Sales | Cost of goods/services | Materials, inventory cost |

| ACC Levies | Accident Compensation Levy | Employee compensation tax |

| Advertising | Advertising Expenses | Ads, promotional materials |

| Bad Debts | Uncollectable receivables | Write-offs from unpaid invoices |

| Communication | Communication Costs | Phone, internet, postage |

| Depreciation | Depreciation of assets | Annual asset depreciation |

| Entertainment | Entertainment Expenses | Client entertainment, event costs |

| Home Office | Home Office Expenses | Office space rent portion, utilities |

| Insurance | Insurance Premiums | Business insurance, liability |

| Interest | Interest Expenses | Loan interest, credit card interest |

| Legal and Accounting | Professional Fees | Legal consultation, audit fees |

| Motor Vehicle | Vehicle Expenses | Fuel, maintenance, insurance |

| Power | Electricity Costs | Power consumption |

| Rent and Rates | Premises Costs | Office rent, property tax |

| Repairs and Maintenance | Maintenance Costs | Equipment repair, facility cleaning |

| Salary and Wages | Employee Compensation | Salaries, wages |

| Travel and Accommodation | Travel Expenses | Business travel, accommodation, transport |

| Other Expenses | Other Business Expenses | Other business-related costs |

| Gain/Loss on Asset Disposal | Asset Sale Gain/Loss | Proceeds from selling assets |

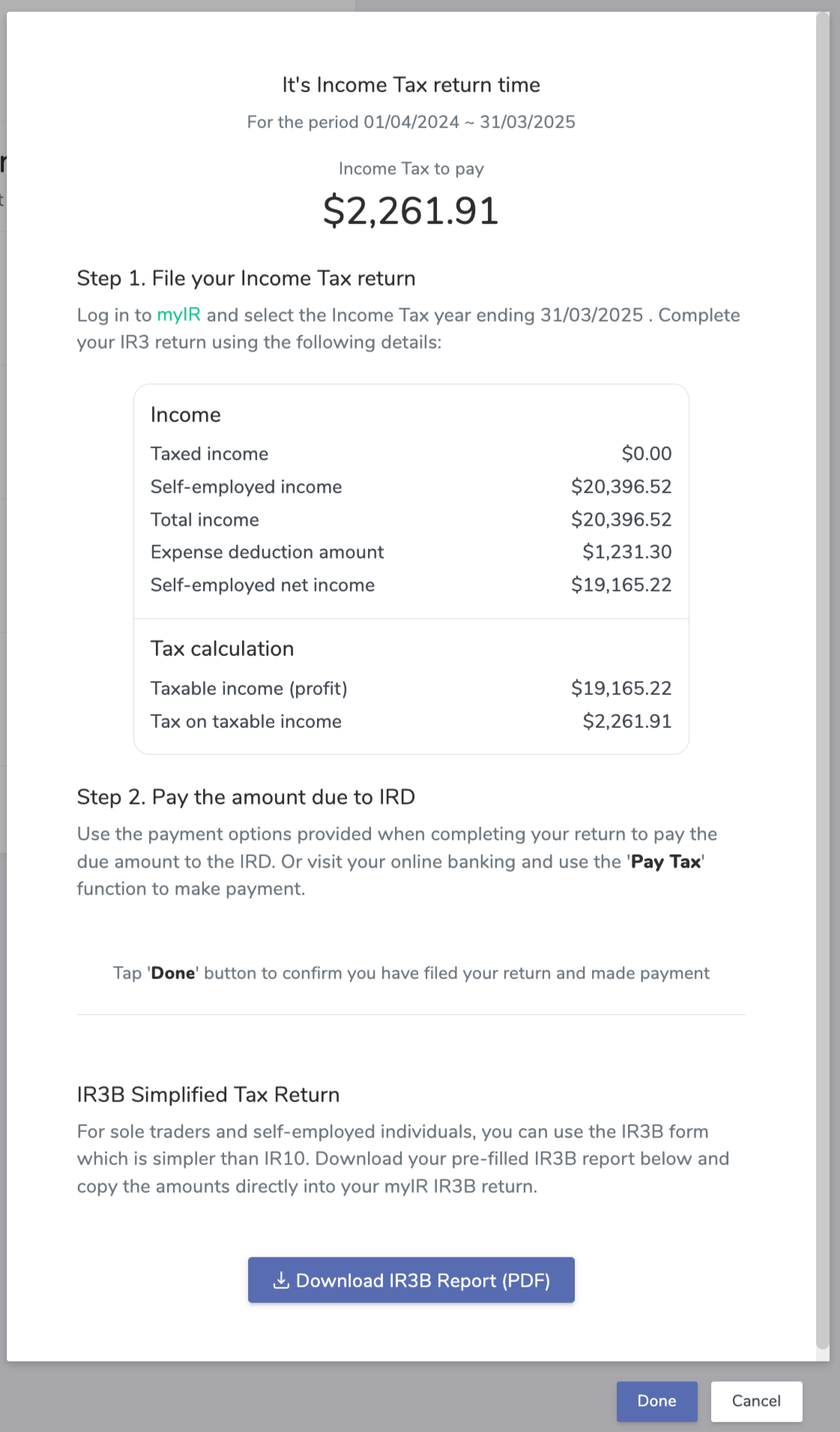

Using the IR3B Download Feature

Step One: Navigate to Income Tax Filing Page

- Log into PayTax.NZ

- From the main menu, select "Tax" (Taxes)

- Find the tax period you want to file

- Click "View & Pay" button

Step Two: Download IR3B Report

- Enter the tax period detail page

- Scroll to the bottom of the page

- Find "IR3B Simplified Tax Return" section

- Click "Download IR3B Report (PDF)" button

- PDF file automatically downloads to your computer

Step Three: Get Data from PDF

The downloaded PDF contains:

1. Company Information Section

- Company name

- IRD number

- Financial year

2. Income Section

- Self-employed income

- Taxed income

- Total income

3. Expense Details Section

- Each expense category total

- Formatted to match IRD standards

- Easy to read and copy

4. Asset-Related Section

- Asset depreciation amount

- Gain/Loss on asset disposal (if applicable)

5. Summary Section

- Total income

- Total expenses

- Net profit/loss

Step Four: Copy Data to myIR

Now you can:

- Open New Zealand IRD myIR account: https://myir.ird.govt.nz/

- Navigate to IR3B filing

- Enter data according to the PDF

- Data is verified and ready to copy

IR3B Report Data Sources

| Report Item | Data Source |

|---|---|

| Sales Income | income_self_employed_amount + income_taxed_amount |

| Expense Categories | Aggregated from expenses by type |

| Depreciation | asset_depreciation_amount |

| Asset Disposal Gain/Loss | asset_disposal_gain_amount - asset_disposal_loss_amount |

Expense Categorization Best Practices

To ensure accuracy of your IR3B report:

-

Categorize Expenses Correctly

- Select appropriate category when recording

- Use "Other Expenses" if uncertain

-

Review Categories Regularly

- Monthly check for miscategorization

- Make corrections promptly

-

Retain Expense Documentation

- Keep all receipts and invoices

- Prepare for IRD review

-

Record All Transactions Promptly

- Don't omit any income or expenses

- Complete records ensure accuracy

Frequently Asked Questions

Q: Can I use this feature if I haven't used PayTax.NZ before? A: Yes, as long as you've correctly recorded your income and expenses in PayTax.NZ, you can use the IR3B download feature.

Q: Does the generated IR3B report need to be signed? A: The report itself doesn't need signature. You'll need to electronically sign when filing through myIR.

Q: What if my expense categories don't quite match? A: You can adjust them when copying to myIR. The system uses standard IRD categories that you may need to map to your specific situation.

Q: Can I download reports for multiple periods? A: Yes. You can download a separate IR3B report for each tax period.

Q: How long does report generation take? A: Usually instant. If you have many transactions, it may take a few seconds.

Tips for Using IR3B

-

Prepare Early

- Complete all records at least a week before period end

- Allow time for review and adjustment

-

Keep Copies

- Save the PDF copy after download

- Maintain for your filing records

-

Update Regularly

- Record transactions throughout the year

- Don't wait until period end

-

Seek Professional Help

- If uncertain about categorization, consult an accountant

- PayTax.NZ provides standard categorization guidance

Integrating Assets with IR3B

Role of Asset Depreciation in Tax Filing

When you own fixed assets, annual depreciation is automatically included in your IR3B report:

-

Depreciation Calculation

- Calculated based on your chosen method

- Applied within the financial year

-

Automatic IR3B Inclusion

- Depreciation automatically added to "Depreciation" category

- Treated as deductible expense

-

Tax Benefits

- Reduces taxable income

- Lowers tax liability

Asset Disposal and Taxes

When you sell or scrap an asset:

-

Disposal Gain/Loss Calculation

- System automatically calculates disposal gain/loss

- Included in IR3B filing

-

Tax Impact

- Disposal Gain = Increases taxable income

- Disposal Loss = Decreases taxable income

-

Report Display

- Shown in "Gain/Loss on Asset Disposal" category

- Amount clearly displayed

Summary

Key Points

✅ Asset Management

- Properly record and classify your fixed assets

- Select appropriate depreciation method

- Operate in accordance with NZ IRD standards

✅ Tax Filing

- Use IR3B to simplify your tax filing

- Leverage PayTax.NZ's automation features

- Ensure data is accurate and complete

✅ Integrated Benefits

- Asset depreciation automatically calculated in IR3B

- Asset disposal gains/losses automatically included

- Time-saving and accuracy guaranteed

Next Steps

-

Set Up Your Assets

- List all fixed assets

- Create asset records in PayTax.NZ

-

Configure Tax Information

- Ensure tax periods are correctly configured

- Verify company information

-

Record Transactions

- Regularly record income and expenses

- Properly categorize each transaction

-

Prepare for Filing

- Download IR3B report at period end

- Use data to complete myIR filing

Additional Resources

- New Zealand IRD Website: https://www.ird.govt.nz/

- IRD IR3B Form: https://www.ird.govt.nz/-/media/project/ir/home/documents/forms-and-guides/ir1---ir99/ir3b/ir3b-2024.pdf

- PayTax.NZ Help Center: See in-app documentation for more information