How GST works in PayTax.nz

Updated At : Thu, Dec 26, 2024

GST (goods and services tax) is often the most time consuming sole trader tax. But don't worry, this article will take you through what GST is, how it works and how you can use PayTax.NZ to simplify and master your GST returns.

What is GST?

GST is a 15% tax added to the price of most products and services. Most things you buy have GST added to the price.

When you sell products or services you might need to add GST to your prices and pass the GST to the IRD when you file your GST returns.

You can claim the GST back on your expenses. When filing your GST return, you work out the difference between the amount of GST you collected on your income and the GST you paid on your expenses. If you collected more GST than you paid, you pay the balance to the IRD when you file your GST return. If you paid more GST than you collected, you can get a GST refund from the IRD.

You can choose to file and pay GST returns monthly (12 per year), 2-monthly (6 per year) or 6-monthly (2 per year).

Do I have to pay GST?

You do not have to register for GST just because you start a business. However, you do need to register for GST if you made over $60,000 in the last 12 months, or if you expect you will make over $60,000 in the next 12 months.

The $60,000 income limit does not include the following income types:

• Salary and wages

• Benefits, pension and student allowance

• Long-term rental income (short-term rental should be included)

• NZ interest

How to register for GST

You can register for GST on the IRD website at any time:

• Log into myIR

• Select the 'I want to...' tab

• Select 'Register for new tax accounts'

• Select your IRD number

• Select 'Goods and services tax (GST)'

• Complete all the sections under 'General info' and 'GST registration'

• Submit your registration

During the registration process, you will be asked to select your 'return filing frequency' and 'accounting basis'.

• Filing frequency – Refers to how often you need to file your GST returns. The default is 'Two-monthly – periods ending in odd months' and we recommend this option in most cases. If you'd like to file GST more often you can select monthly, or if you want to file less often select 'Six-monthly'. If you select six-monthly, you will also need to select the filing months. The months refer to the last month of the GST periods. We recommend using 'March and September' because it aligns with the financial year.

• Accounting basis – Refers to when you account for GST. With the 'Payments basis (cash)' option, GST is calculated on your transactions (when you receive the money). With the 'Invoice basis (accruals)' GST is calculated when you issue the invoice (when you don't yet have the money). PayTax.NZ only supports the 'Payments (cash)' accounting basis. This prevents you from getting caught out having to pay GST on income that you might not have received yet.

Once registered for GST you need to:

• Charge GST to your customers

• File GST returns

• Pay any GST you owe to the IRD

How do I calculate GST in PayTax.NZ?

When you enable GST in PayTax.NZ, PayTax.NZ will automatically calculate GST on your income and expenses, remind you when your GST returns are due and provide you with all the figures you need to simply copy and paste into your GST returns.

To enable GST in PayTax.NZ all you need to do is:

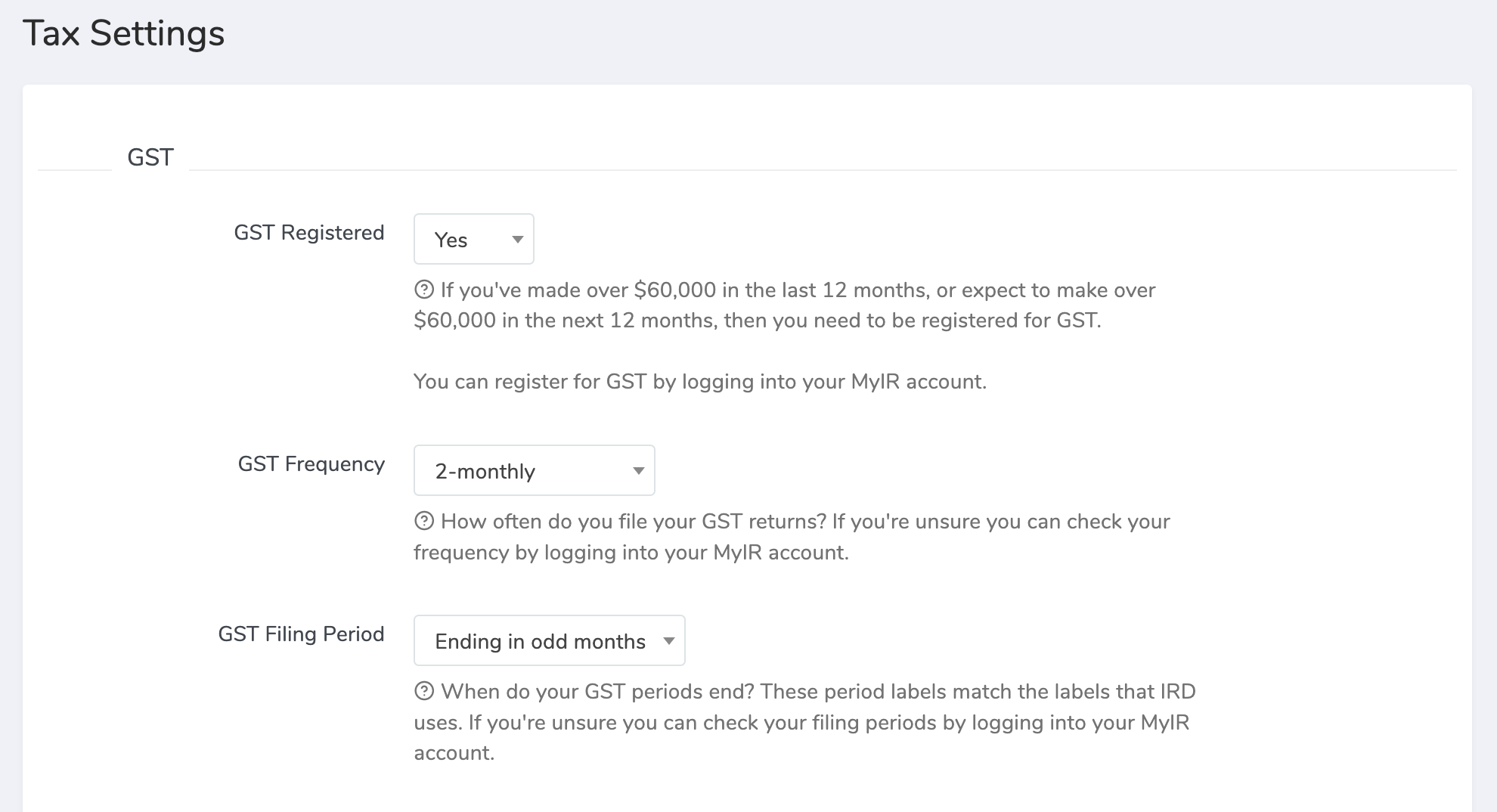

1. Go to the Settings > Tax Settings page in the main menu.

2. Select Yes from the GST registered drop-down list.

3. Select your GST Frequency (and Filing periods if relevant).

4. Click Save & Edit.

More info: How to configure your settings

Once you have enabled GST in your settings, PayTax.NZ will then automatically calculate GST on your transactions and display your GST periods on the PayTax.NZ Dashboard and on the Taxes page.

Note: You can override the GST on a transaction at any time.

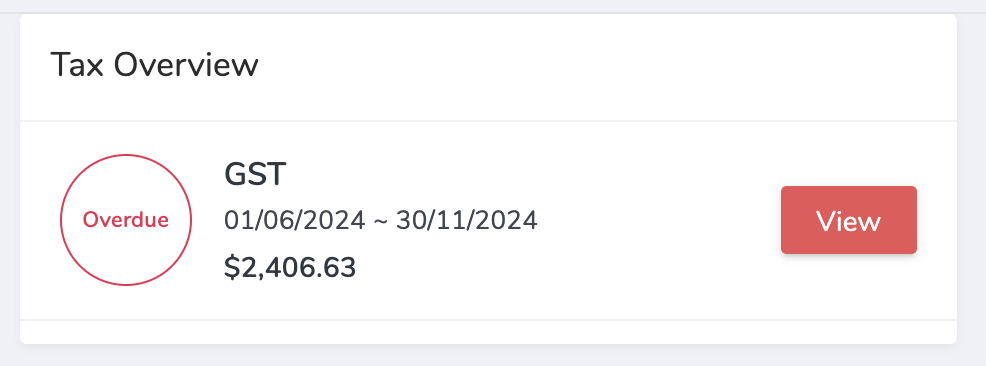

In the Tax Overview on the PayTax.NZ Dashboard, you will see all currently active tax periods. These are tax periods that are either due or the period that you are currently in.

When a GST period becomes due (or overdue), go to the Taxes page to file and close the period.

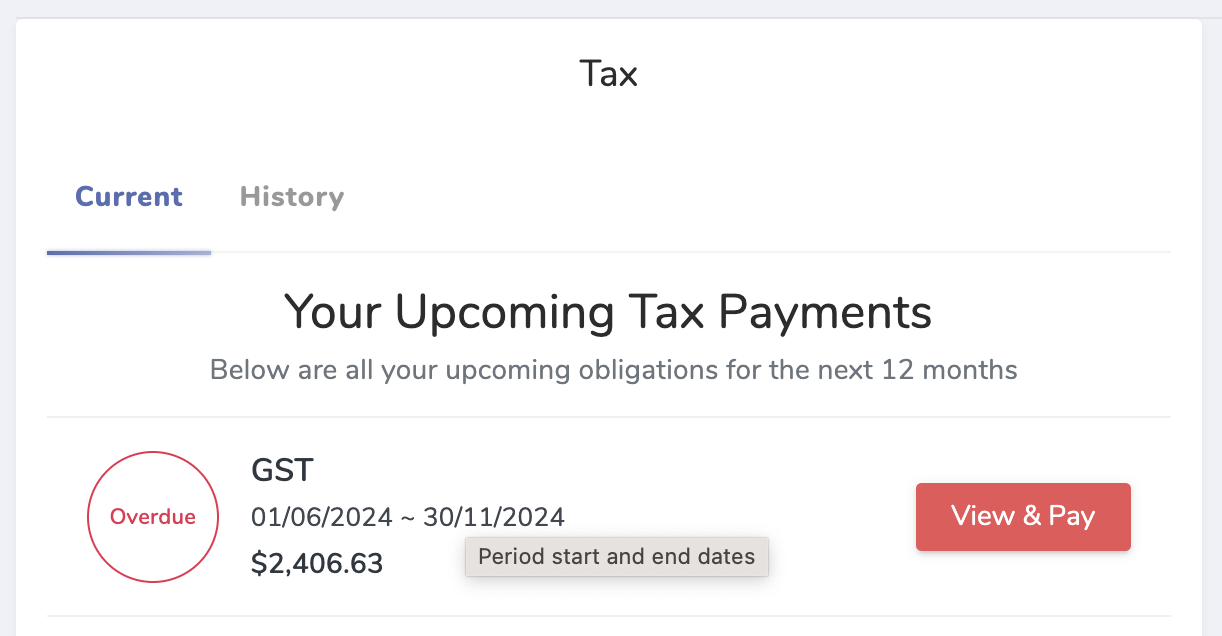

On the Taxes page, you will see all your tax periods for the current financial year and any periods that will become due within the next 12 months.

How to file and pay a GST period

When a GST period becomes due:

1. Go to the Taxes page in the main menu.

2. Click on the View & Pay button for the due period.

Note: The 'View & Pay' button will only be displayed once the period is due. If a period is currently active, but not yet due, you will see a 'Preview' button instead.

Next, follow the instructions that are shown when you click the 'View & Pay' button:

1. File your GST return

When your GST return becomes due you need to login to your myIR account and file your GST return using the figures that PayTax.NZ has calculated.

To file your GST return:

1. Log in to myIR.

2. Click Returns and transactions under 'GST' in your summary.

3. Click File return for the due period.

4. Select GST components (you can also use 'Total sales and purchases').

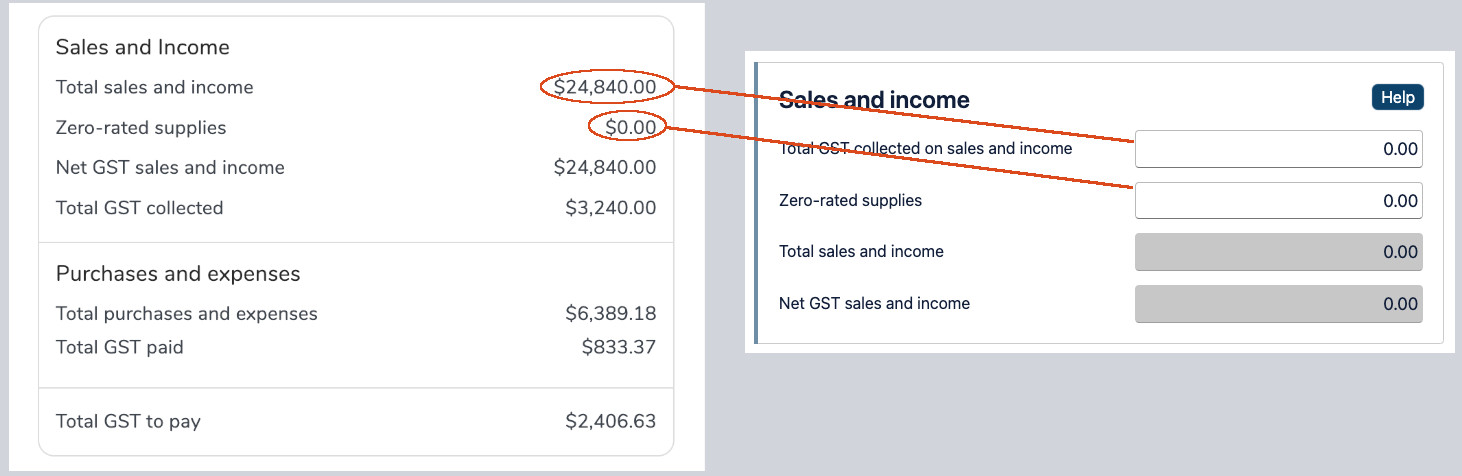

5. Enter the Total GST collected and Zero-rated supplies figures generated by PayTax.NZ and click Next (you shouldn't need to enter any debit adjustments, PayTax.NZ has automatically included adjustments in its calculations).

6. Enter the Total GST paid figure generated by PayTax.NZ and click Next (you shouldn't need to enter any credit adjustments, PayTax.NZ has automatically included adjustments in its calculations).

7. You should now see a Total GST to pay or a Total GST refund figure that matches the calculation in PayTax.NZ. Check the declaration box and click Next.

8. Adding attachments/receipts is optional, click Next.

9. Select if you would like to make payment (generally it's easier to make payment now rather than later). If you select yes, then follow the steps to make payment.

10. Click Submit.

2. Pay the amount due to the IRD

Use the payment options provided when completing your return to pay the due amount to the IRD. Or visit your online banking and use the 'pay tax' function to make payment.

Note: PayTax.NZ doesn't handle any tax payments to the IRD. Tax payments need to be made outside of PayTax.NZ directly from your bank to the IRD.